Controller vs Comptroller: The X-Rated Difference You Need to Know!

When it comes to financial roles, the terms controller and comptroller are often used interchangeably, but they’re not identical. Understanding the controller vs comptroller difference is crucial for businesses and professionals alike. While both roles focus on financial management, their responsibilities, scope, and historical origins set them apart. This blog dives into the X-rated (expert-level) details you need to know to distinguish between these two critical positions, whether you’re hiring for your company or advancing your career in finance, financial management, accounting roles, or corporate finance.

What is a Controller? (Financial Management, Accounting Roles)

A controller is a senior-level executive responsible for overseeing a company’s accounting operations. Their primary focus is on maintaining accurate financial records, ensuring compliance with accounting standards, and producing financial reports. Key responsibilities include:

- Managing the general ledger and accounting systems.

- Preparing financial statements (income statement, balance sheet, cash flow statement).

- Supervising accounting staff and processes.

- Ensuring compliance with GAAP (Generally Accepted Accounting Principles) or IFRS (International Financial Reporting Standards).

Controllers are essential in industries requiring precise financial tracking, such as manufacturing, retail, and healthcare. (Financial management, accounting roles, corporate finance)

What is a Comptroller? (Corporate Finance, Financial Oversight)

A comptroller (derived from “controller general”) historically held a broader role, often at the governmental or organizational level. Today, the term is used interchangeably with “controller” in some regions, but in others, it signifies a higher-level position with additional responsibilities, such as:

- Overseeing financial planning and strategy.

- Managing risk and internal controls.

- Acting as a liaison between the organization and external auditors.

- Ensuring long-term financial health and sustainability.

Comptrollers are more common in government agencies, large corporations, and nonprofit organizations. (Corporate finance, financial oversight, risk management)

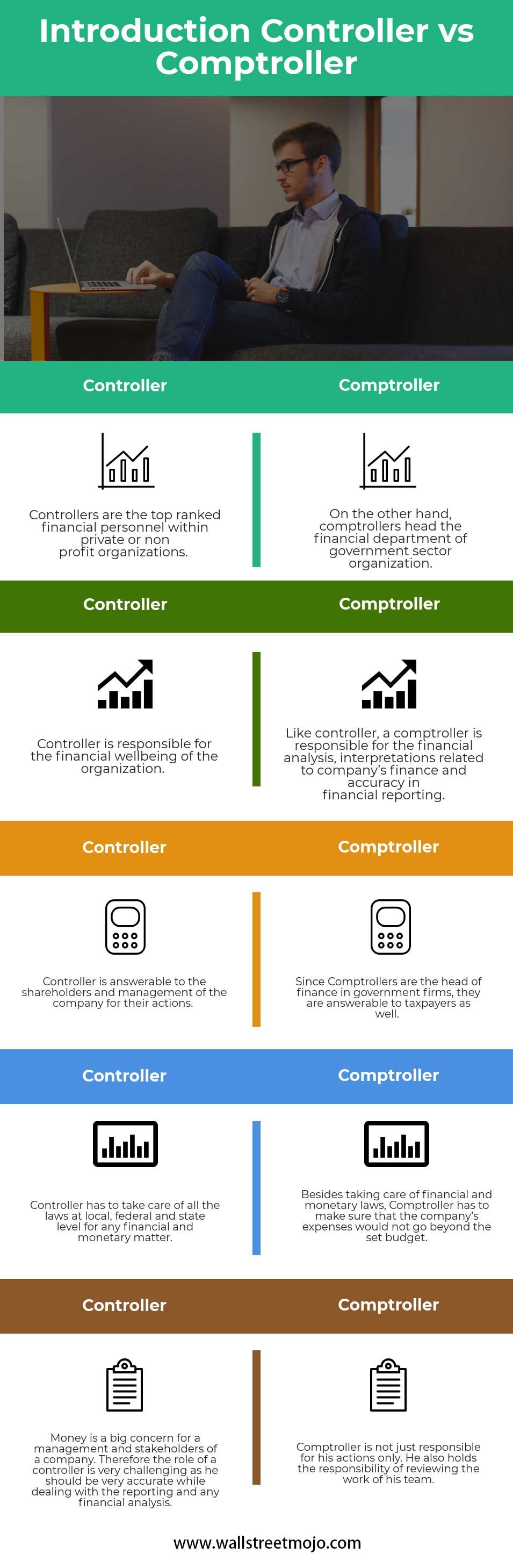

Key Differences: Controller vs Comptroller (Financial Management, Accounting Roles)

| Aspect | Controller | Comptroller |

|---|---|---|

| Focus | Day-to-day accounting operations | Strategic financial management |

| Scope | Narrower, within accounting department | Broader, across the organization |

| Common Industries | Private sector (retail, manufacturing) | Government, large corporations |

While the roles overlap, the comptroller often has a more strategic and overarching role compared to the controller’s operational focus. (Financial management, accounting roles, corporate finance)

How to Choose Between a Controller and Comptroller (Corporate Finance, Financial Oversight)

Deciding whether to hire a controller or comptroller depends on your organization’s needs:

- Hire a Controller if: You need someone to manage day-to-day accounting tasks and ensure compliance.

- Hire a Comptroller if: You require strategic financial leadership and risk management expertise.

💡 Note: In some organizations, one person may hold both titles, especially in smaller companies. (Corporate finance, financial oversight, risk management)

Checklist: Controller vs Comptroller (Financial Management, Accounting Roles)

Use this checklist to determine which role suits your needs:

- ✅ Do you need someone to handle daily accounting tasks? (Controller)

- ✅ Are strategic financial planning and risk management priorities? (Comptroller)

- ✅ Is compliance with accounting standards your main concern? (Controller)

- ✅ Do you require someone to oversee long-term financial health? (Comptroller)

(Financial management, accounting roles, corporate finance)

In summary, while the roles of controller and comptroller may seem similar, their focus and scope differ significantly. Controllers excel in operational accounting, while comptrollers take on a more strategic financial leadership role. Understanding these differences ensures you make the right hiring decision or career move in the fields of financial management, accounting roles, or corporate finance.

Can one person be both a controller and comptroller?

+

Yes, especially in smaller organizations, one person may hold both titles, managing both day-to-day accounting and strategic financial responsibilities.

Is a comptroller higher than a controller?

+

In some organizations, a comptroller holds a higher-level, more strategic role compared to a controller, but this varies by industry and region.

What qualifications are needed for these roles?

+

Both roles typically require a degree in accounting or finance, with controllers often holding a CPA (Certified Public Accountant) and comptrollers having additional experience in financial strategy.